Optimal Tax Bunching When Saving-to-Give

Kinda tax advice, but not Tax Advice, so please don't sue me over it

Takeaways up front

If the following all apply to you:

You live in the US,

You take the standard deduction when you file taxes, and

You donate a decent fraction of your money to tax-deductible charities,

then you should consider continually setting aside and investing your money for a few years (consulting this table to see the “optimal” number of years), donating your accumulated investments it all in one year, and repeating this process. This will save you some money on your taxes, because you’ll be donating more than the standard deduction.

Intro

Saving-to-give is a great way to donate more effectively. You can take your 10% Giving What We Can pledge and make it go a lot farther (and do a lot more good) by saving and investing your pledged money and then donating it later.

My earlier post, A Practical Guide for Saving to Give, laid out how you might invest their funds to give away at a later date. However, it didn’t address how long you should save your money for. This post will consider one key part of that question: how can you minimize your taxes while saving to give?

Note that everything that follows is only applicable to US residents; I don’t know anything about other tax codes, sorry!

Taxes and the standard deduction

You have to pay taxes on your investment gains. However, in this scenario, you’re assuming you’re donating your appreciated stocks directly to a charity of your choice, which will let you not pay any taxes on those gains.

You get to deduct charitable donations (including donations of stocks) from your income when you’re calculating taxes. So if you had $5,000, then you invested until it was worth $10,000, you’re able to deduct $10,000 from your income when you calculate your taxes (in the year you donate the stocks.) And, you don’t have to pay taxes on any of the gains. This is extremely generous from the IRS, and one of the reasons why saving-to-give is so worth it.

There's a wrinkle to this, though, which is that you must itemize your deductions to do this, rather than taking the standard deduction. Basically, when you file taxes, you can choose to either deduct from your income: A.) lots of little things that the government says are deductible or B.) one flat amount of money that the government sets. For most people, option B.) is a better choice, simply due to the numbers involved.

The standard deduction is currently $13,850 (for single filers). This means if you donate less than $13,850 in a year, you get absolutely no tax advantage from donating. Even if you donated $15,000, you’d only be getting an extra tax advantage on the $1,150 difference between your donation and the standard deduction.

This presents us with an opportunity: you can save your money for a several years, taking the standard deduction each year, until you’re ready to donate a bigger chunk of money. At that point, you donate all of your appreciated stocks, far surpassing the standard deduction and greatly reducing your income that year. This approach lets you minimize your taxes paid by taking advantage of the standard deduction as a “free” deduction.

The next question, naturally, is how long should you save it before donating it? I’ll crunch some numbers and find out.

A caveat here is that I’m assuming you don’t have any other deductions that you could itemize. There are various other things you can itemize, including some medical expenses, mortgage interest, and property taxes. Depending on your situation, you might be in a position where you would be better off simply itemizing every year, regardless if you donate to charity or not. In this case, you don’t get an extra advantage to tax bunching, and you can stop reading here.

The optimization problem

I’ll build a simple model to simulate the problem. I will assume:

You file your taxes as an individual, taking the standard deduction

You have a fixed income every year

You put a fixed percentage of that income every year into an investment account

That investment account earns a fixed percent return every year

Every X years, you take all of the money in your investment account and donate it to charity, itemizing your deductions if it’s greater than the standard deduction

You do the above for 40 years, donating your entire savings at the end of the 40 years

I will calculate the lifetime taxes paid under different values for X. I can then find which X minimized those taxes paid.

Predictions

You’d expect that you should save for a few years if you’re donating less money, because you want to be able to get over the standard deduction a few times over your lifetime. As you start donating more money, you’d expect that you just want to donate every year, because if you save for a while, you start offsetting money from lower tax brackets.

Results

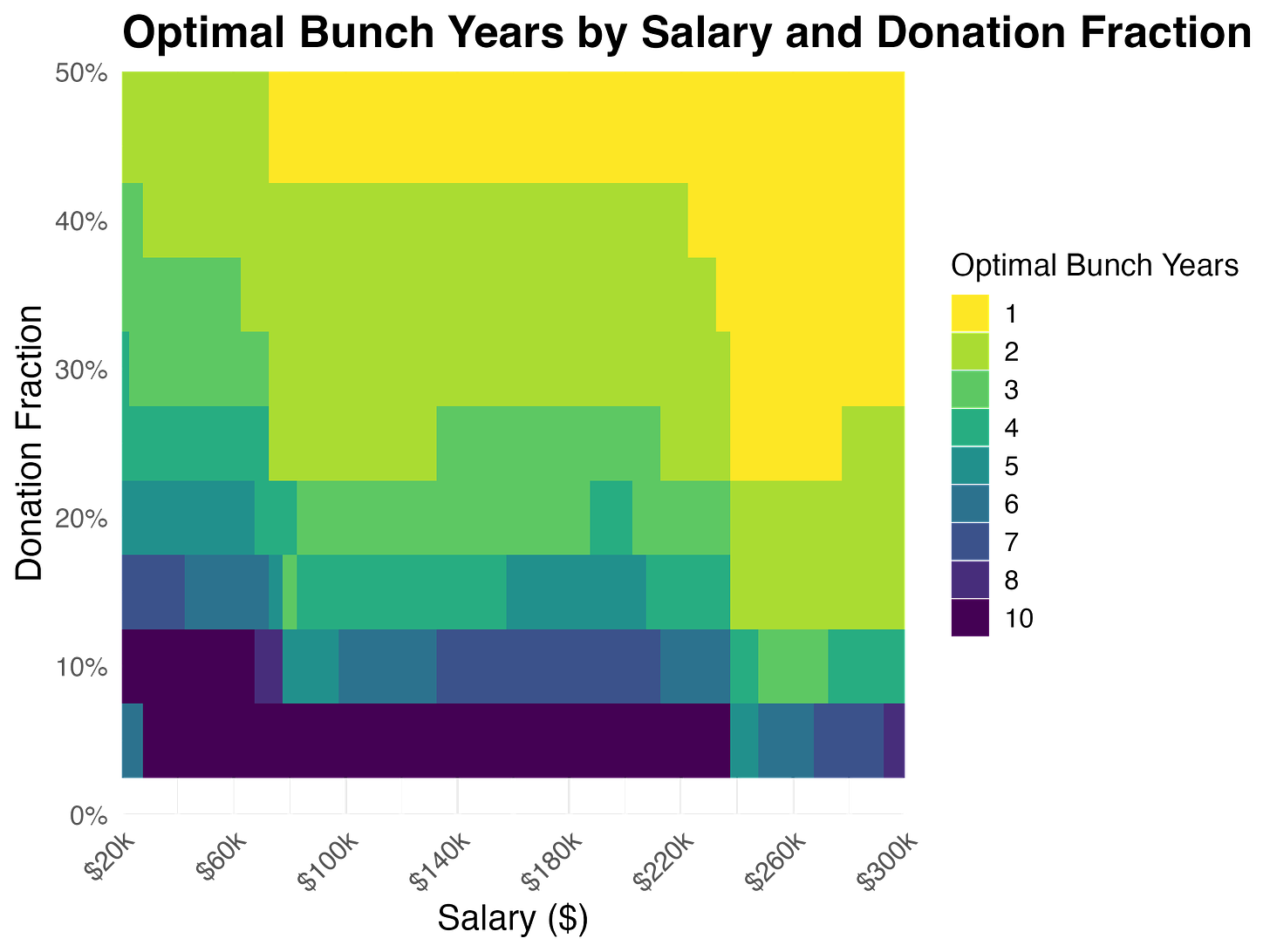

In one chart, here are the results of this simulation:

You can also read all the raw data here in a nice table that will let you find the results for your situation.

You can check out the github here, although it’s very quick and unorganized.

For every salary and donation level, you can see how many years you should save before you donate. The results match my predictions: If you’re making a lot of money, or donating a very large fraction of it, you should just donate every year, because you want to maximize the amount of money you donate in the highest tax bracket.

If you’re not making much money, you want to save for a few years to clear the standard deduction hurdle. Indeed, it’s optimal to save for 10 years at lower amounts, so you can get a large tax advantage from your money by clearing the standard deduction.

How much would this save?

Let’s do an example to see how much money you’d save with this strategy. Assume you’re making $100,000 and you’re giving 10% of your income away. The table says that you should save for 6 years.

If you donated every year, you’d pay $14,261 every year (which I get by applying the tax brackets to our salary that’s been reduced by the standard deduction).

If you save every 6 years as the model says to do, you’d end up paying $12,665 in taxes, on average, each year. That’s a savings of $1,596 each year.

You can see the results for all of these comparisons in the full table results.

Extensions to the model

There are a few other things you could add here:

There’s some chance of value drift, where you suddenly stop donating to charity and decide to keep all your money. You could model this by depreciating your assets by some fixed percentage every year.

You’re probably investing your money, which means you should save for longer. You could add a fixed rate of return every year (or even a return randomly chosen from a distribution of possible returns).

You might think that the value of your ability to do good declines or improves every year, so you could add another “available opportunity” rate to account for this.

Ultimately, I don’t think any of these will dramatically change the results, and I don’t think this is a type of model that’s meant to give precise results. Which leads me to…

How much to trust this model

Optimizing stuff is fun, and it’s easy to get nerd sniped by a fun problem like this. However, in the real world, things are messy and weird. There’s lots of little details that might make this analysis useless for your particular situation. In general, I would use these results as a rough rule-of-thumb, and not take it super seriously whether to donate every 3 years vs every 4 years. I do think it makes sense to save and bunch donations, but agonizing over when precisely to donate won’t help you that much.

For one example: this year, I planned to donate all of my save-to-give funds, after I had been saving for a few years. However, I’ve been donating to a few 501(c)(4) entities and political campaigns (which are not tax-deductible). So, I’m probably not going to be able to get a big tax break this year. Consider this before hand-wringing about any numbers in the above chart or table: your plans might shift and your previous planning might not help you at all.

In my opinion, it’s also a little weird to take a pledge to donate some percent of your money every year, and then save that money for 5+ years before donating it. I probably would never save for more than 5 years, even if I’m paying extra taxes as a result.

Final thoughts

People vary in how they go about doing good in the world. Maybe your goal is to know you’re having an impact on an ongoing, routine basis, and then maybe this saving and bunching thing isn’t for you. And that’s totally fine! You’re foregoing perhaps a few thousand dollars a year to get the benefit of knowing you’re having an impact every month, and you don’t have to deal with these weird administrative complexities.

However, if you like managing your finances and maximizing your money, you should consider

Taking your money that you’ve earmarked in donations and putting it in a stock brokerage,

Saving it for a few years (perhaps consulting this table to see roughly how many years),

Then donating these appreciated stocks directly to your desired charities.